National Bank of Pakistan Jobs 2024 Online Apply

National Bank of Pakistan Jobs 2024 Online Apply, NBP Jobs 2024 apply Online,www.sidathyder.com.pk careers, National bank of Pakistan jobs 2024 last date, NBP Jobs application form, National Bank of Pakistan Jobs online apply, Sidat Hyder NBP jobs 2024, NBP Jobs Cash Officer, Sidat Hyder Jobs National Bank,

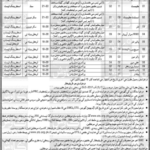

Career Opportunities at National Bank of Pakistan

“The Nation’s Bank”, National Bank of Pakistan (NBP), aims to support the financial well-being of the nation and enable sustainable growth and inclusive development through its wide local and international network of branches. Being one of the leading and largest banks in Pakistan, NBP contributes significantly towards the socioeconomic growth of the country, striving to transform the institution into a future-fit, agile, and sustainable bank.

In line with our strategy, the Bank is seeking talented, dedicated, and experienced professionals for the following positions in the area of Inclusive Development based in Karachi. Qualified individuals who meet the below basic eligibility criteria are invited to apply.

Position Details

1. Wing Head – SME Policy, Product Development & Research (VP / SVP)

- Reporting to: Divisional Head – Commercial & SME

- Qualifications:

- Minimum Graduation or equivalent from an HEC recognized institution.

- Preferably a Master’s degree from an HEC recognized institution.

- Experience:

- Minimum 15 years of banking experience, with at least 5 years in a managerial role in SME Product Management.

- Preferably experience in SME lending business.

- Skills/Knowledge Required:

- Proven success in product development or management roles within the banking industry.

- Strong understanding of SME market dynamics, customer needs, and competitive landscape.

- Excellent leadership, interpersonal, analytical, and problem-solving skills.

- Sound knowledge of regulatory requirements and financial principles.

- Proficient in MS Office.

- Responsibilities:

- Develop and execute comprehensive product programs for SMEs.

- Conduct market research and drive product innovation.

- Oversee the entire product lifecycle and ensure regulatory compliance.

- Build and lead a high-performing team.

2. Wing Head – SME (VP/SVP)

- Reporting to: Divisional Head – Commercial & SME

- Qualifications:

- Minimum Graduation or equivalent from an HEC recognized institution.

- Preferably a Master’s degree from an HEC recognized institution.

- Experience:

- Minimum 15 years of banking experience, with at least 5 years in a managerial role in SME lending.

- Preferably experience in SME portfolio management and product development.

- Skills/Knowledge Required:

- Proven success in establishing and managing SME loan portfolios.

- Strong understanding of SME lending products and regulatory requirements.

- Excellent leadership, analytical, and problem-solving skills.

- Proficient in MS Office.

- Responsibilities:

- Establish, develop, and maintain SME portfolio.

- Monitor credit portfolio and ensure adherence to SBP regulations and bank policies.

- Lead a team and manage credit processing and approvals.

3. Wing Head – Commercial (VP/SVP)

- Reporting to: Divisional Head – Commercial & SME

- Qualifications:

- Minimum Graduation or equivalent from an HEC recognized institution.

- Preferably a Master’s degree from an HEC recognized institution.

- Experience:

- Minimum 15 years of banking experience, with at least 5 years in a managerial role in Corporate and/or Commercial lending.

- Preferably regional/cluster level experience in Corporate and/or Commercial lending.

- Skills/Knowledge Required:

- Proven success in managing loan portfolios.

- Strong understanding of lending products and regulatory requirements.

- Excellent leadership, analytical, and problem-solving skills.

- Proficient in MS Office.

- Responsibilities:

- Develop and maintain Commercial portfolio.

- Monitor market trends and competitor activities.

- Lead a team for credit processing and approvals.

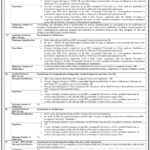

4. Unit Head – Supply Chain Financing & Strategic Alliances (AVP/VP)

- Reporting to: Wing Head – SME Policy, Product Development & Research

- Qualifications:

- Minimum Graduation or equivalent from an HEC-recognized institution.

- Preferably a Master’s degree from an HEC-recognized institution.

- Experience:

- Minimum 8 years of banking experience, with at least 4 years in Supply Chain Financing and/or Strategic Alliances.

- Preferably experience in SME lending business.

- Skills/Knowledge Required:

- Proven success in Supply Chain Financing & Strategic Alliances roles.

- Strong understanding of financial market and SME market dynamics.

- Excellent leadership, analytical, and problem-solving skills.

- Proficient in MS Office.

- Responsibilities:

- Develop and enhance products related to supply chain financing.

- Conduct market research and manage institutional client relationships.

- Collaborate with internal and external partners to structure financing solutions.

5. Product Manager – Non-Farm Sector (AVP/VP)

- Reporting to: Wing Head – Agri. Policy & Product Development

- Qualifications:

- Minimum Graduation in relevant fields from an HEC-recognized institution.

- Preferably a Master’s degree in relevant fields from an HEC-recognized institution.

- Experience:

- Minimum 7 years of banking experience, with at least 3 years in Agriculture Product Management.

- Preferably experience in Agri. Lending.

- Skills/Knowledge Required:

- Strong product development and management skills.

- Adequate knowledge of agri. lending principles and SBP regulations.

- Advanced analytical knowledge of data management.

- Proficient in MS Office.

- Responsibilities:

- Review and propose amendments to existing non-farm agri. products.

- Develop new products for non-farm sector in various areas.

- Coordinate with stakeholders and ensure product integration with Bank’s systems.

6. Unit Head – Agri. Insurance (OGI/AVP)

- Reporting to: Wing Head – BIU & MIS

- Qualifications:

- Minimum Graduation in relevant fields from an HEC recognized institution.

- Preferably a Master’s degree in relevant fields from an HEC recognized institution.

- Experience:

- Minimum 5 years of banking experience, with at least 3 years in regulatory reporting of insurance schemes.

- Preferably experience in Agri. Lending.

- Skills/Knowledge Required:

- Strong data collection and reporting skills.

- Adequate knowledge of SBP regulations and agri. insurance best practices.

- Proficient in MS Office.

- Responsibilities:

- Develop and enhance insurance products.

- Manage data and report to SBP/Govt.

- Liaise with insurance companies and ensure timely reimbursements.

7. Product Manager – SME Policy & Product (OGI/AVP)

- Reporting to: Unit Head – SME Policy & Product Development

- Qualifications:

- Minimum Graduation or equivalent from an HEC recognized institution.

- Preferably a Master’s degree from an HEC recognized institution.

- Experience:

- Minimum 5 years of banking experience, with at least 3 years in SME Product Management.

- Preferably experience in SME lending business.

- Skills/Knowledge Required:

- Proven success in SME product development.

- Strong understanding of SME market dynamics and regulatory environment.

- Proficient in MS Office.

- Responsibilities:

- Develop and execute product programs for SMEs.

- Conduct market research and drive continuous improvement of products.

- Ensure compliance with regulatory requirements and internal policies.

8. Assistant Product Manager – SME Policy & Product (OG II/OG I)

- Reporting to: Product Manager – SME Policy & Product

- Qualifications:

- Minimum Graduation or equivalent from an HEC-recognized institution.

- Preferably a Master’s degree from an HEC-recognized institution.

- Experience:

- Minimum 3 years of banking experience, with at least 1 year in SME Product Management.

- Preferably experience in SME lending business.

- Skills/Knowledge Required:

- Strong understanding of SME banking needs and regulatory environment.

- Proficient in MS Office.

- Responsibilities:

- Develop and execute product programs for SMEs.

- Conduct market research and monitor product performance.

- Ensure compliance with regulatory requirements and internal policies.

Application Process

- Only shortlisted candidates meeting the basic eligibility criteria will be invited for test and/or panel interview(s).

- Employment will be on a contractual basis for three years, renewable at the Management’s discretion.

- Selected candidates will be offered a compensation package and other benefits as per the Bank’s policy/rules.

- Interested candidates may visit the website www.sidathyder.com.pk/careers and apply online within 10 working days from the date of publication of this advertisement as per the given instructions.

- Applications received after the due date will not be considered.

- No TA/DA will be admissible for test/interview.

National Bank of Pakistan is an equal opportunity employer and welcomes applications from all qualified individuals, regardless of gender, religion, or disability.

PID(K)3266/23

Official Advertisement

www.sidathyder.com.pk careers,

National bank of pakistan jobs 2024 last date,

NBP Jobs application form,

National Bank of Pakistan Jobs online apply,

Sidat hyder NBP jobs 2024,

NBP Jobs Cash Officer,

Sidat Hyder Jobs National Bank,